Blog

Today in Stocks: Wipro, Zomato, HDFC Life Lead Gains as Indices End Flat

Mumbai, August 14, 2025 – The Indian stock market ended the day on a flat note, with the Nifty 50 and Sensex closing marginally higher, reflecting a cautious investor sentiment amid mixed global cues and domestic corporate earnings.

Market Overview

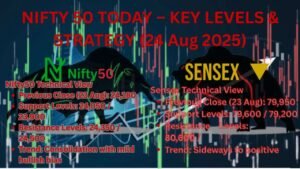

- Nifty 50 closed at 24,616, showing little change from its previous close.

- Sensex ended at 82,340, up by just 12 points, indicating a lack of strong directional momentum.

- Market breadth was mixed, with about 48% of stocks gaining and 52% declining.

Investors adopted a wait-and-watch approach, digesting ongoing macroeconomic data, earnings announcements, and global market developments.

Sectoral Performance

- IT and FMCG sectors were among the top performers, supported by strong quarterly results and positive business outlook.

- Banking and financial stocks remained subdued as investors awaited RBI guidance on interest rate trends.

Top Gainers

- Wipro surged 3.2% after reporting robust revenue growth and securing several new international contracts.

- Zomato climbed 2.8%, buoyed by strong quarterly earnings and optimistic guidance on user growth and profitability.

- HDFC Life rose 2.5% following encouraging updates on policy sales and expansion in the retail insurance segment.

Top Losers

- Select pharma and metal stocks dragged indices lower, with Dr. Reddy’s and Tata Steel seeing minor declines amid global pricing pressures.

- Energy stocks remained under pressure as crude oil futures showed volatility in international markets.

Global Cues & Investor Sentiment

Markets across Asia remained mixed, influenced by data on U.S. consumer spending and ongoing geopolitical developments. The Dow Jones and S&P 500 ended slightly lower, while European equities closed mostly flat.

Analysts say Indian markets are showing resilience despite global uncertainty, with domestic consumption and IT exports providing stability.

Outlook

Experts suggest that the market may continue to trade in a narrow range in the near term, as investors await upcoming corporate earnings, RBI monetary policy updates, and global macroeconomic indicators.

Trading Tips:

- Investors are advised to focus on fundamentally strong stocks in IT, FMCG, and insurance sectors.

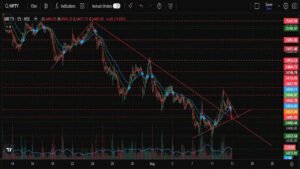

- Short-term traders may watch key support and resistance levels for Nifty 50 (24,500 – 24,700) and Sensex (82,200 – 82,500) to plan intraday strategies.

Conclusion

The Indian stock market’s flat finish reflects a cautious approach by investors amid mixed domestic and global factors. While IT, insurance, and consumer stocks outperformed, overall sentiment remains neutral, suggesting that traders should remain selective and focus on sectors with strong earnings visibility.

- Trending