Blog

NSE Nifty 50 Trade Setup Today (22 August 2025): Key Levels, Strategy & Market Outlook

Introduction

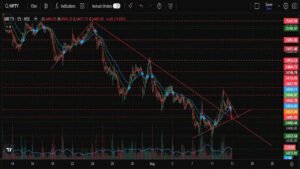

The NSE Nifty 50 entered a decisive zone on 22nd August 2025, after five consecutive sessions of gains. The index closed at 25,083.75 on 21st August with a modest gain of 0.13%. Now, traders are closely watching whether Nifty can sustain above 25,150–25,200 or face a pullback towards 25,000 levels.

Market Recap

- Nifty closed at 25,083.75 with minor gains.

- Foreign Institutional Investors (FIIs) sold shares worth nearly ₹1,100 crore.

- Domestic Institutional Investors (DIIs) provided strong support by buying around ₹1,800 crore.

- The daily candlestick pattern showed a lower shadow, suggesting strong intraday buying interest.

Key Technical Levels

. Resistance (R1–R3): 25,140 → 25,200 → 25,323

- Support (S1–S3): 25,070 → 25,031 → 24,950

Technical indicators are giving mixed signals. While RSI and CCI show bullish momentum, MACD and ROC remain weak. Stochastic and Williams %R suggest overbought conditions, which calls for caution.

Trade Strategies

🔹 Bullish Setup

- Entry: On a 15-min close above 25,154

- Targets: 25,243 → 25,323 → 25,435

- Stop Loss: Below 25,154

🔹 Bearish Setup

- Entry: On a close below 25,070

- Targets: 25,031 → 24,950 → 24,855

- Stop Loss: Above 25,070

🔹 Sideways / Neutral

If Nifty remains between 25,070–25,154, it is better to avoid trading until a clear breakout or breakdown happens.

Market Outlook

The Nifty 50 is currently at a pivotal juncture. A breakout above 25,154 can open the doors for a rally toward mid-25,000 levels, while a breakdown below 25,070 may lead to profit-booking and correction towards 24,950–24,855 levels. Traders should use strict stop losses and avoid aggressive trades in range-bound conditions.

Disclaimer: Trading involves high risk. This analysis is based on market data & technical indicators, not a guarantee. Always do your own research.

- Trending