Blog

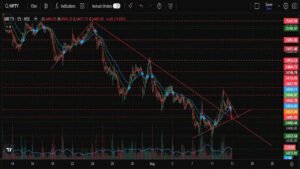

NSE Nifty 50 & Sensex Trade Setup – 24 August 2025

The Indian stock market is expected to remain active on 25 August 2025, as Nifty50 and Sensex are closely watched by intraday traders and investors. Moreover, after recent consolidation, market participants are looking for key breakout levels, support/resistance zones, and options strategies to maximize opportunities.

📊 Market Overview

- Global cues remain mixed: US bond yields, crude oil prices, and FII flows will influence the market open.

- On the other hand, domestic DIIs continue to provide support, keeping markets stable.

- In fact, Nifty50 has shown sideways movement recently, suggesting a range-bound day with occasional breakout attempts.

Therefore, traders should watch for sudden momentum shifts, which may create short-term opportunities.

📈 Nifty50 Technical Levels

- Previous Close: 24,950

- Support Levels: 24,800 / 24,650

- Resistance Levels: 25,150 / 25,300

- Trend: Range-bound with mild bullish bias

Strategy:

- Bullish Scenario: If Nifty crosses 25,150, it may test 25,300–25,350.

- However, a drop below 24,800 could trigger short-term selling.

- Additionally, range-bound traders may fade trades near support/resistance zones.

Consequently, understanding these levels helps intraday traders plan entries and exits efficiently.

📊 Sensex Technical Levels

- Previous Close: 80,150

- Support Levels: 79,800 / 79,500

- Resistance Levels: 80,400 / 80,600

- Trend: Sideways to slightly positive

Strategy:

- Bullish: A breakout above 80,400 may target 80,600–81,000.

- Conversely, failure to hold 79,800 may bring weakness.

Moreover, Sensex movements often set the tone for sectoral and mid-cap stocks, making monitoring crucial for traders.

🎯 Intraday Strategy

- Bullish Scenario: Buy near support zones if Nifty sustains above 25,000; target resistance 25,150–25,300.

- Bearish Scenario: Sell rallies into 25,150–25,300 if momentum weakens; target 24,800.

- Range-bound Trading: Fade trades near support/resistance zones.

In fact, having a clear intraday plan reduces emotional trading and improves risk management.

📌 Options Strategy

- Bullish (Limited Risk) – Bull Call Spread:

- Buy 24,950 CE

- Sell 25,300 CE

- Profitable if Nifty crosses 25,150

- Neutral / Range Play – Iron Condor / Short Strangle:

- Sell OTM call & put around expected range 24,650–25,300

- Volatility Play – Long Straddle:

- Buy ATM call + put if expecting a big move (>100 points)

Additionally, always check real-time option-chain for premiums, OI, and liquidity. Thus, staying updated reduces surprises in volatile markets.

✅ Risk Management Tips

- Risk ≤1–2% of capital per trade

- Always use stop-loss (underlying or premium based)

- Limit daily loss to 3–5% of capital

- Avoid naked positions without hedging

- Trade strikes with high OI and tight bid-ask spreads

Moreover, disciplined risk management ensures long-term survival in trading.

Consequently, always use stop-loss and avoid over-leveraging in volatile conditions.

Disclaimer

Trading involves high risk. This analysis is based on market data & technical indicators. It should not be considered financial or investment advice.

- Trending