Blog

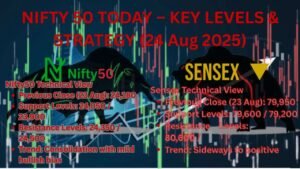

Indian Markets Slump: Sensex & Nifty Slide Amid Global Uncertainty

The Indian stock markets ended in negative territory today, as weak global cues and persistent selling pressure weighed on investor sentiment. Consequently, both benchmark indices slipped, reflecting cautious trading.

- Sensex closed at 79,809.65, down 270.92 points (0.34%).

- Nifty settled at 24,426.85, down 74.05 points (0.30%).

Key Reasons Behind the Slump

- Global Market Weakness: Asian and US markets faced selling pressure; as a result, Indian equities moved lower.

- FII Outflows: Foreign Institutional Investors (FIIs) continued selling, thereby impacting overall market sentiment.

- Rising Crude Oil Prices: Higher energy costs triggered inflationary concerns, which further pressured the indices.

- Rupee Under Pressure: A weaker rupee against the US dollar also dampened investor confidence.

Sector-Wise Performance

- Banking & Financials: HDFC Bank, ICICI Bank, and other lenders ended lower; similarly, the sector overall showed weakness.

- IT Stocks: Infosys, TCS, and Wipro declined due to global tech spending concerns, meanwhile some smaller IT firms managed minor gains.

- Energy & Oil Stocks: Reliance Industries and ONGC contributed to the negative momentum, while some midcap energy stocks remained stable.

- Pharma & FMCG: Defensive sectors managed marginal gains; however, these could not offset overall market losses.

Expert Views

Analysts noted that after a strong rally, a correction was expected. Therefore, they suggested investors focus on long-term opportunities, while remaining cautious in the short term. Moreover, staying updated with global cues is essential.

Outlook Ahead

With global uncertainties persisting, volatility may continue in the coming sessions. As a precaution, experts recommend sticking to defensive sectors and avoiding heavily leveraged positions. Additionally, investors should monitor crude oil and currency movements closely.

Disclaimer: The content provided on this website/blog is for informational and educational purposes only. It should not be considered financial, investment, or trading advice. Stock market investments carry risks; therefore, please consult your financial advisor before making any decisions.

- Trending