Blog

Explosive Nifty Bullish Momentum: Can the Index Hit 26,000 by Diwali?

The Indian stock market has been riding a wave of optimism in recent weeks, with the Nifty index showing strong signs of bullishness. Investors and traders are closely watching the market’s trajectory as experts suggest that the Nifty bullish momentum could push the index toward 26,000 by Diwali. With key sectors performing well and festive demand adding fuel to the rally, this target does not appear out of reach.

In this article, we explore the factors driving the rally, sector-wise performance, and the possible risks that could influence the market before the festival season.

Why Analysts Believe in Nifty Bullish Momentum

Market experts highlight that the Nifty has recently crossed 25,400, a level that reflects strong buying interest. Technical analysts argue that if the index sustains above 25,500, it could gradually move to 25,750, setting the stage for a run toward 26,000.

Rajesh Palviya, a well-known market strategist, believes the Nifty bullish momentum is backed by robust fundamentals. A combination of rising corporate earnings, improved investor sentiment, and steady inflows from foreign institutional investors (FIIs) have given the market a strong foundation.

Key Drivers Behind the Rally

Several factors are contributing to the upbeat sentiment in Indian equities:

1. Banking and Financial Stocks Lead the Way

Banking stocks, especially PSU banks and NBFCs, are playing a crucial role in sustaining the Nifty bullish momentum. Improved asset quality, declining non-performing assets, and healthy credit growth are boosting investor confidence.

2. Festive Season Demand

The upcoming festive season, culminating in Diwali, is expected to bring a surge in consumer spending. Analysts believe that increased demand across sectors like retail, automobiles, and real estate will support the market’s upward trajectory.

3. Global Cues

Global equity markets are currently stable, with declining inflationary pressures and expectations of rate cuts from major central banks. This supportive environment has enabled FIIs to re-enter emerging markets like India, further fueling the rally.

4. Strong Corporate Earnings

Recent quarterly results have shown resilience across sectors. The power, chemicals, and IT industries have posted healthy earnings, reinforcing the view that the market has solid fundamentals behind its rise.

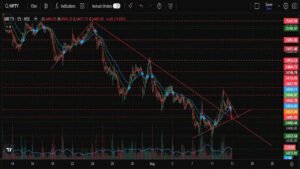

Technical Outlook: Is 26,000 a Realistic Target?

From a technical perspective, the Nifty bullish momentum has established a strong support zone near 25,200. As long as the index holds above this level, analysts expect buying pressure to continue.

Resistance levels are seen at 25,750 and 25,900, but if these are cleared, the rally could extend toward 26,000 in the short term. Moving averages and momentum indicators are currently in bullish alignment, suggesting that traders have reason to remain optimistic.

Sector-Wise Performance That Supports the Rally

Banking and Finance

PSU banks are leading the charge, supported by government initiatives and stronger balance sheets. NBFCs are also witnessing rising demand for loans, further strengthening the outlook.

Power and Energy

The power sector has been one of the star performers this year. With rising demand for electricity and investments in renewable energy, companies in this space are contributing positively to the Nifty bullish momentum.

Chemicals and Manufacturing

India’s chemical industry continues to attract investor interest due to global supply chain realignments. Manufacturing stocks also remain strong, benefiting from government policies like “Make in India.”

Technology and IT

Although the global IT sector faces some challenges, Indian IT companies have managed to maintain profitability. Steady demand for digital transformation ensures this sector’s relevance in the market rally.

Possible Risks to Watch Out For

While the outlook is broadly positive, investors should remain aware of potential risks:

- Global Economic Uncertainty – Any slowdown in the U.S. or China could affect investor sentiment.

- Geopolitical Tensions – Ongoing conflicts or trade restrictions may disrupt market stability.

- Inflationary Pressures – If inflation rises unexpectedly, the Reserve Bank of India (RBI) could tighten monetary policy.

- Profit Booking – As the Nifty approaches new highs, some traders may book profits, leading to short-term corrections.

Despite these risks, the strong fundamentals suggest that such corrections could be temporary and may even present new buying opportunities.

Investor Sentiment and Market Psychology

A key reason for the ongoing rally is the psychological factor of investor confidence. When markets approach festive seasons, optimism usually runs high. The belief that the Nifty bullish momentum will carry the index higher often becomes a self-fulfilling prophecy, as more investors join the rally.

Retail participation has also increased significantly, with more individuals investing through mutual funds and direct stock purchases. This broad-based participation adds stability to the market’s rise.

Long-Term Outlook Beyond Diwali

Even if the Nifty touches 26,000 by Diwali, analysts suggest that the rally may not end there. Structural reforms, infrastructure investments, and India’s growing role in the global economy provide a foundation for long-term growth.

Sectors like renewable energy, technology, manufacturing, and financial services are expected to drive India’s stock market in the years ahead. For investors with a long-term perspective, the Nifty bullish momentum is not just about short-term gains but also about positioning for future opportunities.

Conclusion: 26,000 Within Reach?

As Diwali approaches, the big question remains: will the Nifty touch 26,000? While markets are inherently unpredictable, the current conditions strongly support this possibility. Robust sectoral performance, festive demand, and strong investor sentiment make the target appear achievable.

For investors, the takeaway is clear: the Nifty bullish momentum is real, and while short-term corrections may occur, the overall outlook remains optimistic. Those who stay disciplined, diversify their portfolios, and focus on long-term trends are likely to benefit the most from this historic rally.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Market investments are subject to risks, including loss of principal. Readers are advised to consult with a certified financial advisor before making any investment decisions. The views expressed are based on publicly available data and may change with market conditions.

- Trending