Blog

Today’s Stock Market Update – Sensex & Nifty Live Highlights | 4 Sept 2025

The Indian stock market showed moderate growth today, 4 September 2025, as investors reacted positively to the government’s latest GST reforms. Initially, gains were strong in the morning; however, profit booking later slowed the momentum. Overall, the market ended on a slightly positive note, reflecting cautious optimism among investors.

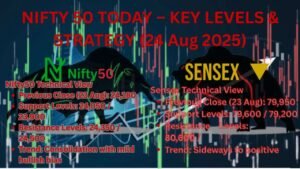

BSE Sensex closed at 80,718.01, up 150.30 points (+0.19%), while NSE Nifty 50 settled at 24,734.30, rising 19.25 points (+0.08%). These figures indicate a steady yet cautious market sentiment, with investors focusing on quality stocks and reliable sectors.

Sector-wise performance today highlighted autos and FMCG stocks as top performers. Specifically, the Nifty Auto index jumped 0.85%, showing strong buying interest, especially in leading auto manufacturers. In addition, FMCG stocks gained modestly at 0.24%, driven by continued demand for consumer goods. On the other hand, IT stocks struggled, with Nifty IT declining 0.94%, affected by profit booking and global tech market trends.

Top Gainers today included:

- M&M

- Bajaj Finance

- Bajaj Finserv

- Apollo Hospitals

- Nestle

Top Losers included:

- HDFC Life

- Tata Consumer

- Wipro

Key Reasons Behind the Market Move

- GST Reforms: Government reforms in GST boosted investor sentiment, particularly in autos and FMCG sectors.

- Profit Booking: After early gains, some investors booked profits, therefore causing moderate declines in IT and midcap stocks.

- Sector Trends: Investors preferred stable, growth-oriented stocks while remaining cautious about volatile midcap and smallcap shares.

Investment Tip: For cautious investors, sectors like Auto, FMCG, and Pharma show stable growth potential. Moreover, avoiding volatile stocks during uncertain times is recommended.

Conclusion:

In summary, today’s market reflects a mix of optimism and caution. While reforms and positive news drove growth in certain sectors, overall market sentiment remained careful. Hence, investors should stay updated and focus on quality stocks for sustainable growth.

- Trending